Tech

Technology And Car Insurance Premiums

Technology in cars has come a long way even in recent years. Dashboards and front consoles are now decked out with communicative, safety, performance, and luxury features made possible by streamlining tech products that we regularly use in our everyday life. Smartphone charging and integration devices are other tech features becoming more commonplace in cars. There are even some driving around with TVs on the back of seats. But with all these great, sometimes flashy features, where does that leave the cost of auto insurance? Never mind the obvious higher asking prices for tech-filled cars at the dealer lots, but what about maintaining the car insurance that is more than likely required? Needless to say, the premiums will be higher with such features now. However, some car insurance companies are known to provide small discounts for those that drive technologically safe cars.

Popular Technology For Cars

The most popular technological features available for cars are those that assist with or make driving safer. This includes cruise controls, parking assist, cameras, lane changing notifications, and blind-spot detection. These types of features aren’t for the sake of luxury or being flashy but actively contribute to the car’s safety rating, which is what car insurance companies look at when underwriting a policy. These are features that they like to see and will even reward them with small discounts. Some of these features are becoming more common for standard cars, so the discounts don’t make that much of a difference. Still, they are proven to lessen the likelihood of an accident or filing a claim. More luxurious and flashy tech features that have no bearing on the car’s driving ability and safety performance don’t offer the same discounts. In fact, some may result in higher premiums.

When Car Tech Features Will Lead to Higher Premiums

All tech features for a car, for safety or luxury purposes, are mechanical parts. These devices aren’t a single piece but rather several small parts making up a complex device and its functions. With all these moving parts, it will cost a bit more to repair, considering the components and replacement costs. This is especially the case for the most technologically advanced features on the market and why newer cars often have higher insurance premiums than older ones. That is also why more vast coverage for cars with features such as these is often a good idea with auto coverages like comprehensive and collision. Of course, this means you will be paying more for car insurance since you desire more coverage –another reason why tech features can increase your premiums. Another way to think about it is that it costs around $1,845 to fix a motion detector bumper. Now, it’s around $3,550.

Discounts For Safety Features

Without beating around the bush, we can tell you that drivers with safety features on their cars, add-on or standard, apply for discounts of a maximum of 5%, and even that is a little bit of a stretch. The average that people report saving when it comes to this kind of discount is around $2.25 a year.

Cars And Technology in The Future

There is no question of whether or not new tech features will be added to cars in the future. Rather, it’s a question of how much more it’s going to cost and maintain car insurance for. However, as these features become commonplace, we may see insurance rates begin to even out and lower –but that may have to come later.

Tech

Geekzilla.tech Honor Magic 5 Pro: A Deep Dive Into Features, Specs, and Performance

The smartphone market continues to evolve rapidly, and in 2024, flagship devices are pushing boundaries further than ever before. One such device is the Geekzilla.tech Honor Magic 5 Pro, a premium smartphone that combines cutting-edge technology with an elegant design. In this comprehensive article, we take a closer look at the Honor Magic 5 Pro’s features, specifications, and performance, breaking down what makes this phone stand out in a highly competitive market.

Geekzilla.tech honor magic 5 pro

The Geekzilla.tech Honor Magic 5 Pro is the latest flagship from Honor, packed with powerful hardware and innovative features designed to impress. From its stunning display to its advanced camera system, the device is engineered to provide a premium user experience. Whether you’re a gamer, photographer, or casual user, the Magic 5 Pro aims to offer something for everyone. But does it live up to the hype? Let’s explore.

2. Design and Build Quality

Premium Materials and Ergonomics

The Honor Magic 5 Pro stands out with its sleek, sophisticated design. Crafted from high-quality materials such as glass and aluminum, the phone exudes a premium feel that competes with the likes of the Samsung Galaxy S24 and iPhone 15. The ergonomic design ensures a comfortable grip, making it easy to use with one hand despite its large size.

Display Quality

The Magic 5 Pro boasts a 6.78-inch OLED display with a 3200 x 1440 resolution. Colors are vibrant, and the sharpness is impressive, making it perfect for gaming, watching movies, or editing photos. The 120Hz refresh rate ensures smooth scrolling and fluid animations, while its peak brightness level allows for easy readability even in bright sunlight.

3. Key Features and Specifications

Here’s a detailed table of the Honor Magic 5 Pro specifications:

| Feature | Specifications |

|---|---|

| Display | 6.78-inch OLED, 3200 x 1440 resolution, 120Hz refresh rate, HDR10+ |

| Processor | Qualcomm Snapdragon 8 Gen 2 |

| RAM | 8GB / 12GB |

| Internal Storage | 256GB / 512GB UFS 4.0 (non-expandable) |

| Operating System | Magic UI 7.0 (based on Android 13) |

| Main Camera | Triple-camera setup: 50MP (wide) + 50MP (ultra-wide) + 64MP (periscope telephoto, 3.5x optical zoom, 100x digital zoom) |

| Front Camera | 12MP (wide) |

| Video Recording | 8K at 30fps, 4K at 60fps, 1080p at 120fps, gyro-EIS |

| Battery Capacity | 5,000mAh |

| Charging | 66W wired fast charging, 50W wireless charging, reverse wireless charging |

| Connectivity | 5G, Wi-Fi 6, Bluetooth 5.2, USB Type-C |

| Water & Dust Resistance | IP68 (dust and water resistant) |

| Security Features | In-display fingerprint scanner, 3D facial recognition |

| Dimensions | 163.9 x 74.5 x 8.7 mm |

| Weight | 219 grams |

| Colors | Black, Green, Gold |

| Price (starting) | $1,100 (8GB/256GB variant) |

The Honor Magic 5 Pro packs a punch with its Snapdragon 8 Gen 2 chipset, offering lightning-fast performance. It supports 8GB/12GB of RAM and 256GB/512GB of internal storage, catering to users who need ample space for apps, media, and files. Other notable features include 5G connectivity, Wi-Fi 6, and an IP68 rating, which means the device is dust and water-resistant.

4. Performance and Usability

Processor and Chipset

At the heart of the Honor Magic 5 Pro is the Snapdragon 8 Gen 2 processor, a powerhouse chipset that excels in demanding tasks. Whether you’re multitasking, playing graphically intensive games, or streaming high-definition video, the Magic 5 Pro handles everything with ease. Benchmark tests reveal that the device performs on par with other flagship smartphones, making it one of the fastest devices available.

RAM and Storage

With up to 12GB of RAM, the Magic 5 Pro offers smooth performance across various applications. The 256GB/512GB of UFS 4.0 storage ensures fast read/write speeds, allowing for quick app installations and file transfers. Storage is non-expandable, but the large internal capacity should be sufficient for most users.

User Interface and Customization

Running on Magic UI 7.0 (based on Android 13), the Honor Magic 5 Pro offers a user-friendly interface. Magic UI is customizable, with various themes and settings that allow users to tailor the phone’s appearance and functionality. Gestures, dark mode, and split-screen multitasking enhance usability, while the system itself runs smoothly with no noticeable lag.

5. Camera Quality

Main Camera Setup

The camera system is one of the standout features of the Honor Magic 5 Pro. It features a triple-camera setup with a 50MP main sensor, 50MP ultra-wide lens, and 64MP periscope telephoto lens capable of 100x digital zoom. The camera is optimized with AI technology, enabling superior low-light performance, detailed portrait shots, and stunning landscape photography.

Camera Modes

With modes such as Night Mode, AI Ultra Clarity, and Pro Mode, the Magic 5 Pro caters to photography enthusiasts. The Night Mode enhances images in low light, while the AI-powered scene detection adjusts settings to deliver the best results automatically.

Video Recording

The device supports 8K video recording at 30fps and 4K video at 60fps with excellent stabilization, making it a great option for vloggers and content creators. The front-facing camera, at 12MP, also supports high-resolution video calls and selfies with natural-looking bokeh effects.

6. Battery Life and Charging

Battery Capacity

The Honor Magic 5 Pro is equipped with a 5,000mAh battery, offering a full day of use under heavy conditions. On lighter days, users can stretch battery life to nearly two days, making it one of the most reliable batteries among current flagships.

Charging Capabilities

The phone supports 66W fast charging, which can take the battery from 0% to 100% in under an hour. It also includes 50W wireless charging and reverse wireless charging, a feature that allows users to charge other devices, such as earbuds or smartwatches, wirelessly from the phone itself.

7. Connectivity and Software

5G and Wi-Fi

The Magic 5 Pro is future-proofed with 5G support and Wi-Fi 6 technology, ensuring fast data speeds and reliable connections. Whether you’re streaming, gaming, or downloading large files, the device offers robust network performance.

Operating System

Honor’s Magic UI 7.0 is layered over Android 13, offering the latest features from Google alongside Honor’s enhancements. It includes smart assistants, AI photo editing, and gesture controls, making the user experience smooth and intuitive.

Security Features

For security, the Honor Magic 5 Pro includes an in-display fingerprint scanner and 3D facial recognition. Both methods are fast and accurate, ensuring quick access to the device while keeping it secure from unauthorized users.

8. Pricing and Availability

Pricing Options

The Honor Magic 5 Pro is competitively priced for a flagship device. In most regions, it starts around $1,100 for the 8GB/256GB variant, with the 12GB/512GB model priced slightly higher. This puts it in direct competition with other flagship devices like the Samsung Galaxy S24 and the iPhone 15.

Market Availability

The device is available in several regions, including Europe, Asia, and North America. It is sold unlocked, making it compatible with most carriers, and is available through major retailers and Honor’s official website.

9. Comparison with Competitors

Compared to other flagship smartphones, the Honor Magic 5 Pro holds its own in terms of design, performance, and camera quality. While it offers a better battery life and charging speed than the iPhone 15, it competes closely with the Samsung Galaxy S24 in display quality and overall performance. However, the Magic 5 Pro’s camera setup, with its periscope telephoto lens, gives it a unique edge in mobile photography.

10. Conclusion

The Honor Magic 5 Pro is a compelling flagship device that delivers on all fronts. From its high-quality design and powerful performance to its excellent camera system, it is designed to appeal to both tech enthusiasts and casual users alike. While it faces stiff competition in the premium smartphone market, the Magic 5 Pro offers a unique blend of features that make it a standout choice. If you’re looking for a phone that combines cutting-edge technology with a user-friendly experience, the Honor Magic 5 Pro is definitely worth considering.

11. FAQs

- Does the Honor Magic 5 Pro support 5G?

- Yes, the Honor Magic 5 Pro is fully compatible with 5G networks, offering fast download and upload speeds.

- What is the charging speed of the Honor Magic 5 Pro?

- The phone supports 66W wired fast charging and 50W wireless charging.

- Is the Honor Magic 5 Pro waterproof?

- Yes, the device has an IP68 rating, making it dust and water-resistant.

- What operating system does the Honor Magic 5 Pro use?

- It runs on Magic UI 7.0, based on Android 13.

- How does the Honor Magic 5 Pro compare to the iPhone 15?

- While both are premium smartphones, the Magic 5 Pro offers faster charging and more versatile camera options, particularly with its telephoto lens.

Tech

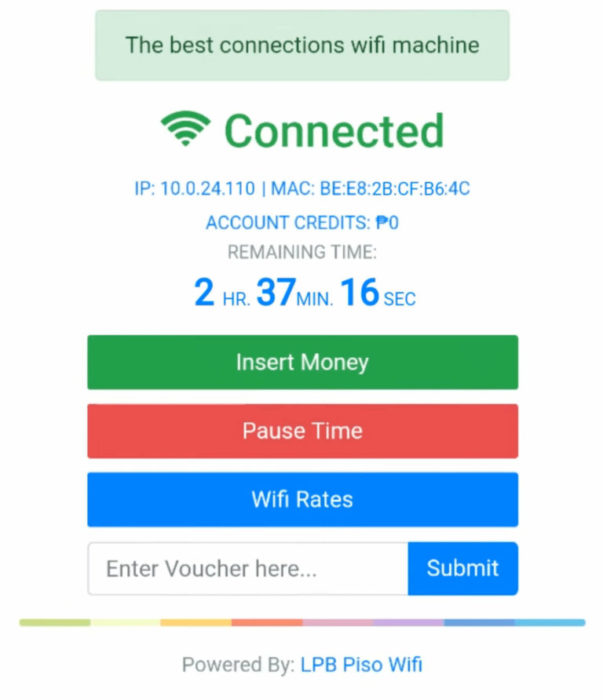

How to Use Piso WiFi Pause Time 10.0.0.1 for Better Network Control

The Piso WiFi system is a widely used public internet service, offering a convenient way to provide internet access to customers in establishments such as cafes, hotels, and even residential areas. However, managing bandwidth and controlling network usage can be challenging, especially when multiple users are connected at once. Fortunately, Piso WiFi comes with a powerful tool to help you manage your network effectively—the Pause Time feature. In this guide, we’ll explain how to use the Piso WiFi Pause Time feature via the 10.0.0.1 admin panel and discuss its benefits and limitations.

What is Piso WiFi Pause Time?

Piso WiFi Pause Time is a function that allows network administrators to temporarily suspend internet access for a set period. Whether you need to reduce excessive usage, save bandwidth, or control the timing of network availability, this feature provides a simple and efficient way to manage your network.

By using the pause function, all users connected to the network will be temporarily blocked from accessing the internet. The default time intervals for the Pause Time feature are 30 minutes, 1 hour, and 2 hours, but these can be customized based on your needs. This makes it easy to manage network availability, either for technical reasons or simply to conserve bandwidth during high-traffic periods.

Also Read: Valorant Walkthrough: How To Lower Ping In Valaront?

Why Use the Piso WiFi Pause Time?

There are several scenarios in which the Piso WiFi Pause Time feature can be helpful:

- Controlling excessive data usage: If certain users are consuming too much bandwidth, pausing the network can help manage data distribution.

- Maintaining control over public WiFi: In establishments like cafes or hotels, the pause feature can be used to enforce timed access to WiFi services.

- Saving bandwidth during off-peak hours: You may want to disable network access during late-night hours when fewer people are using the service.

Now, let’s dive into how you can access and configure the Piso WiFi Pause Time feature.

How to Access the Piso WiFi Admin Panel (10.0.0.1)

Before you can configure the Pause Time settings, you need to log into the Piso WiFi Admin Panel. Follow these simple steps:

- Open your browser: On any device connected to the Piso WiFi network, open your preferred web browser.

- Enter the IP address: Type

http://10.0.0.1in the browser’s address bar and hit Enter. This will take you to the Piso WiFi Admin Panel login page.

- Login credentials: You will be prompted to enter your username and password. These should have been provided when you initially set up your Piso WiFi system.

- Access the Admin Panel: After successfully logging in, you will now have access to the admin dashboard, where you can configure network settings, including the Pause Time feature.

Also Read: Top 5 Games to Boost Your Creativity

How to Set Up and Use the Piso WiFi Pause Time

Once you have accessed the Piso WiFi Admin Panel, follow these steps to configure and activate the Pause Time feature:

- Locate “Internet Access Time”: Scroll through the dashboard until you find the option labeled “Internet Access Time.”

- Choose the pause duration: You will see options for preset time intervals—30 minutes, 1 hour, and 2 hours. Select your preferred duration by clicking on the radio button next to it.

- Apply your selection: Once you’ve chosen the desired time interval, click on the “Apply” button to save your selection.

- Activate the pause function: To activate the pause, look for the “Pause” button beneath the “Internet Access Time” settings. Clicking this button will immediately disable internet access to all connected users for the selected period.

Once the pause function is active, your network will become temporarily inaccessible, and users attempting to connect will be unable to access the internet until the pause period expires or the pause is manually disabled.

Important Notes:

- The pause function is a global network control, meaning it affects all users connected to your Piso WiFi network. There is no option to pause access for specific users only.

- Be cautious when using this feature in a business setting where users may rely on uninterrupted access to WiFi services.

Also Read: How to Fix Modern Warfare 2 Problems/Freezings

Advantages and Disadvantages of Piso WiFi Pause Function

Advantages:

- Bandwidth Management: The pause feature helps you manage bandwidth by preventing users from hogging network resources during peak times.

- Easy Control: It offers an easy way to control network access, particularly in public places where users may be connected to your Piso WiFi for long periods.

- Customizable Timing: You can select from preset intervals or customize the pause duration, giving you flexibility in managing access.

Disadvantages:

- All-or-Nothing Access Control: The pause function affects all users on the network. Unfortunately, you can’t restrict access to just a few users, which can lead to inconvenience for those who aren’t causing excessive usage.

- Potential Customer Dissatisfaction: If you run a business where customers rely on consistent WiFi access, suddenly pausing the network can lead to frustration and complaints.

- Limited Use Cases: For businesses that rely on continuous customer access (such as cafes or co-working spaces), pausing the network might not be practical or desirable.

Understanding these pros and cons can help you make an informed decision about when and how to use the Piso WiFi Pause Time feature.

How to Disable Piso WiFi Pause Time

If you’ve activated the Pause Time and want to restore internet access before the pause period ends, follow these steps to disable the feature:

- Log in to the Admin Panel: Just like before, use

http://10.0.0.1to access the Piso WiFi Admin Panel. - Navigate to “Pause Access”: Once logged in, scroll down to the “Pause Access” section in the dashboard.

- Enter your password: You’ll be asked to confirm your action by entering your admin password.

- Click “Apply”: After entering your password, click “Apply” to deactivate the pause. The network will immediately become accessible to all users again.

Quick Tip:

If you frequently use the pause function, make sure to communicate with your customers or users ahead of time, so they know when the network will be unavailable. This can help avoid unnecessary frustration.

Conclusion

The Piso WiFi Pause Time feature is an excellent tool for managing network usage and controlling bandwidth, particularly in environments where multiple users share a single internet connection. By following the steps in this guide, you can easily activate, configure, and disable the pause function via the 10.0.0.1 Piso WiFi Admin Panel.

However, keep in mind that the pause function is a blunt tool—it affects all users, so it’s not suitable for targeted control. In business environments, especially those reliant on public WiFi access, using this feature requires caution to avoid potential customer dissatisfaction.

Overall, the Piso WiFi Pause Time feature can be a great asset for network management, especially when used strategically. With a clear understanding of its benefits and limitations, you can leverage it to optimize your WiFi network’s performance and user experience.

Casual

Creative Ideas for Best Technology Instagram Post 2024

Are you facing difficulty in engaging your audience with tech posts on Instagram? As social media platforms have transformed into virtual marketplaces, brands recognize the need to showcase expertise through engaging content.

Platforms like Instagram empower connecting with worldwide audiences through captivating visual stories. But, it is quite a daunting task to work and many move ahead to buy Instagram followers as well.

Contemporary consumers scarcely have time for promotion lacking substance. Hence, creatives demand integrating education with entertainment for intrinsically motivating connections. This is why in this post, we discuss top ideas for your tech-posts on Instagram. Read on.

Top Instagram Post Ideas for Technology in 2024

There are many creative and unique ways to catch attention for your technology posts on Instagram. Below we discuss some of the most popular ones that can certainly get all eyes on you.

I. Using Tech Products as Props

Showcasing the ergonomic elegance of newest smartphones through lifestyle photos depicting them harmonizing with modern interiors signifies how technologies enhance lives unobtrusively.

Flat lays carefully arranging phones alongside complementary gadgets like smartwatches and earbuds exhibits compatible accessories apt for varied tasks. Close-up shots exploring interesting details on laptops or cameras from unique angles pique curiosity towards innovative engineering.

Illustrations envisioning people multitasking efficiently through integration of different devices tells stories audiences relate to. Including props within realistic settings displays practical applications beyond technical specifications.

II. Behind the Scenes Photos of Tech

Sneak peeks hinting at cutting-edge features of anticipated device launches grant exclusivity while cultivating hype. Well-lit workplace photographs portray engineers concentrating on prototyping components and inspire admiration.

Snapshots capturing programming teams collaborating wirelessly on interactive whiteboards through mobile apps demonstrate streamlined productivity. Infographics adorning clean designs simplify explaining complex algorithms behind facial recognition or data analytics in accessible language.

Short videos taking viewers inside futuristic factories reveal meticulous manufacturing processes with a sense of intimacy.

III. Infusing Tech with Humor

Lighthearted memes humorously portraying predictable reactions to everyday tech troubles provide comic relief to stressful scenarios. Relatable situations humorously presented divert from serious sales pitches.

Personified tech objects in comical misadventures amuse audiences through humanizing technology. Satires skewering society’s obsession with smartphones in a tongue-in-cheek manner encourages shares to spread smiles. When infused judiciously, humor aids connection by sparking emotions beyond sales.

IV. Showcasing the Human Side of Tech

Introducing changemakers through portraits celebrating their groundbreaking work nurtures admiration. Profiles highlighting individuals transforming lives through accessible education technologies promote empowerment.

Environmental initiatives leveraging automation to offset carbon footprints brings a humanistic face to sustainability efforts. Impactful community projects excelling through connectivity showcase technology uplifting society versus solely profit motives.

Sensitively showcasing stories of overcoming challenges strengthens bonds between brands and audiences.

V. Visual Presentations of Tech Topics

Creative arrangements of flat lays showcasing virtual or mixed reality controllers provides an experiential feel of the immersive tech itself. Sequential photos arranged like puzzle pieces or in grids present complex technical concepts through visual storytelling.

Infographics leveraging minimalist aesthetics simplify explaining blockchain or cloud computing. Illustrations personifying IoT appliances in a “day in life” routine brings relatability to innovations perceived as complex. Data visualizations comparing tech trends succinctly impart industry insights.

VI. Leveraging Trending Tech Themes

Imaginative demonstrations of artificial intelligence streamlining lives pique intrigue towards groundbreaking research. Showcasing developments in robotics, VR or internet of things solving pressing issues cultivates social purpose beyond sales.

Highlighting startups leveraging cutting-edge innovations attracts investors and talent. Curated reels condensing key takeaways from tech summits grant exclusive access. Tactical hashtags around concepts ranging from 5G to cybersecurity optimize discovery of relevant audiences worldwide.

Unique Ways To Boost Engagement

With competition so fierce, it becomes difficult to keep your audience engaged with your post. Below we discuss some essential tips that can make things easy for you. Take a look:

● Researching Optimized Hashtags

Analyzing hashtag clusters witnessing frequent usages around niche conversations aids discovering appropriate tags aligning with targeted audiences. Careful hashtagging aids discoverability and spreads messages to receptive crowds naturally.

● Optimizing Images For Social Formats

Adjusting photos to square dimensions suitable for Instagram feeds and story formats preserves visual quality and context. Proper sizing and cropping focuses viewer attention on essential elements.

● Scheduling Around Peak Engagement Timings

Identifying timing patterns of highest follower activities through analytics aids posting when most eyeballs will likely notice new updates. Repurposing top performing content as story highlights retains visibility.

● Reviewing Engagement And Follower Insights

Regularly evaluating metrics like likes, comments, saves and follower growth rates aids comprehending reception and refining strategies. Tracking identified hashtag or location based communities’ interests guides customized content.

● Partnering With Key Influencers

Reaching wider audiences through cross-promotional shoutouts with popular domain figures expands networks. Collaborations establishing brand authority through third party endorsements bolster credibility.

Final Thoughts

In summary, effectively leveraging visual creativity fueled by data-driven decisions establishes technology companies, alongside support from a dedicated social media growth agency like Thunderclap.it, as thought leaders amid competition on platforms like Instagram.

Consistency, authenticity, and nurturing communities through meaningful interactions are crucial for driving organic visibility and achieving superior returns on social media. While maintaining technical excellence is essential, emotionally connecting with audiences through social missions and humor helps build a loyal following and fosters trust in this experience-driven world.

-

Guides5 years ago

Guides5 years ago6 Proven Ways to Get more Instagram Likes on your Business Account

-

Mainstream10 years ago

Mainstream10 years agoBioWare: Mass Effect 4 to Benefit From Dropping Last-Gen, Will Not Share Template With Dragon Age: Inquisition

-

Casual11 months ago

Casual11 months ago8 Ways to Fix Over-Extrusion and Under-Extrusion in 3D Printing

-

Mainstream12 years ago

Mainstream12 years agoGuild Wars 2: The eSports Dream and the sPvP Tragedy

-

Guides8 months ago

Guides8 months agoExplore 15 Most Popular Poki Games

-

Mainstream6 years ago

Mainstream6 years agoHow to Buy Property & Safe Houses in GTA 5 (Grand Theft Auto 5)

-

Uncategorized4 years ago

Uncategorized4 years agoTips To Compose a Technical Essay

-

iOS Games1 year ago

iOS Games1 year agoThe Benefits of Mobile Apps for Gaming: How They Enhance the Gaming Experience